A criminal is engaged in chain hopping while trying to launder ransomware payments. The criminal will likely:

As part of an internal fraud investigation, an AML officer has decided to interview an employee. Which statement is most consistent with best practices?

A client that runs a non-profit organization that aids refugees in leaving their home countries received a remittance from a money services business that was ten times the average. The client was recently detained for providing falsified passports to illegal immigrants. Which predicate offenses could be considered in the SAR/STR? (Select Two.)

SAR/STR NARRATIVE

A SAR/STR has been submitted on five transactions conducted on the correspondent banking relationship with ABC Bank.

Client Information:

Remitter information: DEF Oil Resource Ltd. is the oldest member of the DEF Group. It was founded in 1977 as a general trading business with a primary focus on exports from Africa and North America. The group has business activities that span the entire energy value chain. Their core field of endeavor is centered within the oil and gas industry and its associated sub-sectors.

Beneficiary Information:

As per the response received from ABC Bank, it was determined that the beneficiaries are related to DEF Oil Resource Ltd. These were created by DEF Oil Resource Ltd. to purchase property in a foreign country on behalf of their senior management as part of a bonus scheme. The purpose behind this payment was for the purchase of property in another country.

Payment Reference:

ABCXXXXX31PZFG2H

ABCXXXXXX51PQGEH

ABCXXXXXX214QWVG

ABCXXXXXX41PSXA2

ABCXXXXXX815QWS3

Concerns:

• We are unsure about the country of incorporation of the beneficiaries.

• We are concerned about the transactional activity since the payment made towards entities (conducted on behalf of individuals) appears to be possible tax evasion.

• There appears to be an attempt to conceal the identity of individuals (senior management), which again raises concerns about the source of funds.

• Referring to the response received from ABC Bank, we are unclear about the ultimate beneficiary of funds.

• The remitter is involved in a high-risk business, (i.e., oil and crude products trading), and the beneficiary is involved in real estate business which again poses a higher risk.

When drafting the SAR/STR narrative, the investigator notes several payment references. What additional information should the investigator include in the narrative?

In a review of the account activity associated with Nadine Kien, an investigator observes a large number of small- to medium-size deposits from numerous individuals from several different global regions. The money is then transferred to a numbered company. Which is the next best course of action for the investigator?

A financial regulator is evaluating the effectiveness of a financial institution's (Fl) anti-financial crime program. Which condition should be met to satisfy the regulator?

CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client ID. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai, India Cell Phone: "*•"'" Alt Phone: "*""* Email: ........"

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020 Sub-sector: Software-Cryptocurrency Exchange Expected Annual Transaction Amount: 125,000 USD Payment Nature: Transfer received from clients’ fund

Received from: Clients

Received for: Sale of digital assets

The client identified itself as Xryptocurrency Exchange." The client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

During the financial crime investigation, the investigator discovers that some of the customer due diligence (CDD) documents submitted by the client were fraudulent. The investigator also finds that some of the information in the financial institution's information depository is false. What should the financial crime investigator do next?

A financial institution (Fl) receives an urgent request for information from the financial intelligence unit (Fl country. According to FATF recommendations, which is the best action for the FI to take?

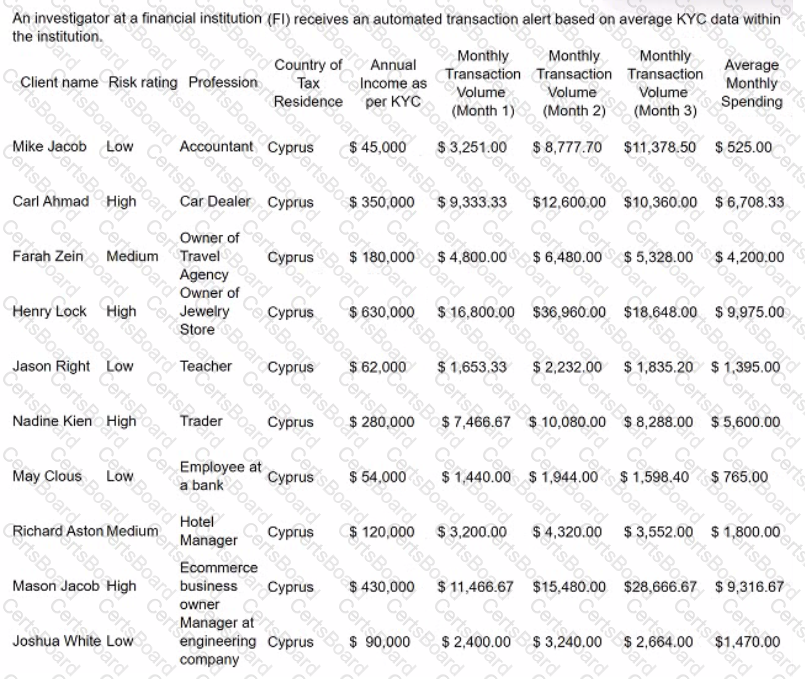

An investigator at a corporate bank is conducting transaction monitoring alerts clearance.

KYC profile background: An entity customer, doing business offshore in Hong Kong, established a banking business relationship with the bank in 2017 for deposit and loan purposes. It acts as an offshore investment holding company. The customer declared that the ongoing source of funds to this account comes from group-related companies.

• X is the UBO. and owns 97% shares of this entity customer;

• Y is the authorized signatory of this entity customer. This entity customer was previously the subject of a SAR/STR.

KYC PROFILE

Customer Name: AAA International Company. Ltd

Customer ID: 123456

Account Opened: June 2017

Last KYC review date: 15 Nov 2020

Country and Year of Incorporation: The British Virgin Islands, May 2017

AML risk level: High

Account opening and purpose: Deposits, Loans, and Trade Finance

Anticipated account activities: 1 to 5 transactions per year and around 1 million per

transaction amount

During the investigation, the investigator reviewed remittance transactions activities for the period from Jul 2019 to Sep 2021 and noted the following transactions pattern:

TRANSACTION JOURNAL

Review dates: from July 2019 to Sept 2021

For Hong Kong Dollars (HKD) currency:

Incoming transactions: 2 inward remittances of around 1.88 million HKD in total from

different third parties

Outgoing transactions: 24 outward remittances of around 9 4 million HKD in total to

different third parties

For United States Dollars (USD) currency:

Incoming transactions: 13 inward remittances of around 3.3 million USD in total from

different third parties

Outgoing transactions: 10 outward remittances of around 9.4 million USD in total to

different third parties.

RFI Information and Supporting documents:

According to the RFI reply received on 26 May 2021, the customer provided the bank

with the information below:

1J All incoming funds received in HKD & USD currencies were monies lent from non-customers of the bank. Copies of loan agreements had been provided as supporting documents. All of the loan agreements were in the same format and all the lenders are engaged in trading business.

2) Some loan agreements were signed among four parties, including among lenders. borrower (the bank's customer), guarantor, and guardian with supplemental agreements, which stated that the customer, as a borrower, who failed to repay the loan

Which additional information would support escalating this account for closure?

A government entity established a trust to provide social welfare programs. The entity wants cash payments made to persons without supporting documentation. These persons would oversee the allocation of funds to beneficiaries without complying with internal disbursement of government funds controls. Which is the main premise for filing a SAR/STR?