The following email has been forwarded to you by William Seaton, Director of Finance:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Email from CFO of Fouce Oil

Hi

This email arrived last night. I need you to help me to think through the various implications of doing what it suggests before I present it to the Board. I need you to focus on the following issues:

Would this proposal make sense from a strategic point of view?

If we did decide to go ahead, what would be the issues that we would have to consider with respect to informing the

stock market?

Could you please email me your thoughts within the next hour? I have to brief the Board later today.

Thanks

William

The email referred to can be found by clicking on the Reference Materials button.

You have just received the following email:

From: William Seaton, Director of Finance

To: Finance Manager

Subject: Oil reserves

Hi,

This email arrived from the Head Geologist earlier today. I am concerned that many of our colleagues understand very little other than rock formations and drilling reports. They certainly misunderstand accounting issues. I have already had some very confused discussions with the other members of the Board.

I need a very clear report from you that I can circulate to the other Board members. I am not particularly interested in the technical accounting rules. I do not think that you necessarily require an accounting standard to tell you that a particular disclosure is misleading.

I need your report to cover the following:

Should we make a public announcement of this information? I would like a clear indication of the implications for our

relationship with our various stakeholders AND the ethical issues that you feel are relevant.

What are the implications for our share price? I would like your analysis to consider the factors that will indicate how

our share price will change upon the announcement.

Thanks

William

The email referred to above can be found by clicking on the Reference Materials button.

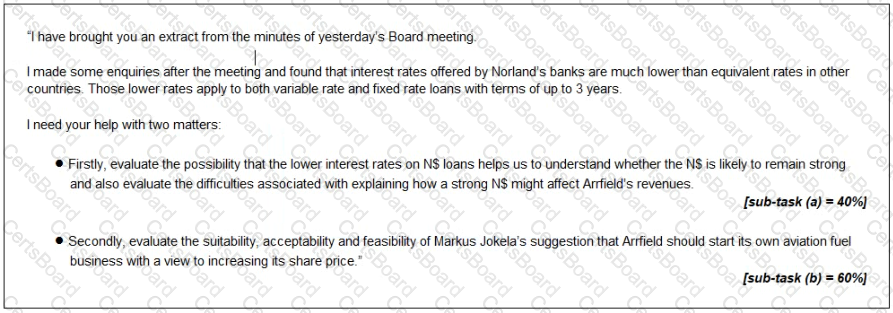

A week later, Romuald Marek stops by your workspace and hands you a document.

The Board minute extract from Romuald can be viewed by clicking the Reference Material button above.

Reference Material

Board minutes extract: proposal to profit from ongoing strength of NS

Anna Obalowu Sole, Chief Operating Officer, reported that the strong NS was helping generate revenues from fuel sales. Discussion followed as to whether the strong N$ was likely to persist and whether a strong N$ benefits Arrfield overall.

Markus Jokela. Chief Executive Officer, stated that the Board should develop contingency plans that could be implemented if it seemed likely that the strong N$ would persist. In particular. Arrfield need not renew the contracts that permit aviation fuel suppliers to operate from its airports. Arrfield would then be free to create its own fuel sale business, buying fuel in bulk to replenish the storage tanks at each of its airports in Norland and then selling it directly to airlines He stated that this would almost certainly enhance Arrfield's share price

Romuald Marek reminded the Board that four of Arrfield's six airports are located in Norland and that those airports charge for aeronautical and non-aeronautical services in N$.

Hello

I have attached a news article

Arrfield does not set the price for aviation fuel sold at our airports, but we do receive a percentage of the revenues earned by the fuel companies.

I need your help to prepare for a Board meeting to discuss this matter Please write a paper covering the following

* Firstly, explain the impact that the criticisms voiced by the environmental campaigners will have on the frequent PESTEL analysis that Arrfield's Board conducts.

[sub-task (a) = 34%

* Secondly, evaluate the commercial logic of Arrfield's strategy of basing charges for non-aeronautical services (such as fuel sales and retail activities) on percentages of the revenues generated by the companies that operate at its airports

[sub-task (b) = 33%)

* Thirdly, recommend with reasons whether Arrfield should attempt to justify strategic decisions to its shareholders when the commercial logic of those decisions is not immediately obvious

[sub-task (c) = 33%}

Thanks

Romuald Marek

Chief Finance Officer

Peter Sorchi, Wodd’s Chief Executive has stopped you in the corridor:

"We signed a memorandum of understanding with the Bravadorian Government last night. Effectively, we are now the new owners of a forest in a new continent for us. It has already made it onto the business pages in the press.

Once the formalities are completed, we will be entering into new commercial territory. Our surveyors have looked at the first area that we intend to develop and there is a lot more hardwood than we first expected. That is good news in a way because it can be sold at a premium, but we don’t have any experience of selling hardwood and we are hardly going to pulp it for MDF or paper. I need you to identify the changes that we will have to make and to recommend how best to manage them.

The funding arrangements are still being worked out. Bravador’s banks are not in a position to fund a transaction of this size and none of the other banks that we have approached are prepared to lend to us. We will need to raise additional equity. I realise that we would normally make a rights issue, but I think that it would be simpler and cheaper to suspend the dividend for a year, which would cover most of the purchase price in itself. Please advise me on the advantages and disadvantages of doing that.

It would be ideal if you could let me have a briefing paper on both of these matters urgently."

Reference Material:

A further eight weeks have passed since the discussion concerning Wodd’s creation of an accredited Forest Certification Service.

Wodd’s Chairman has asked you to a meeting:

"I thought that we had a lucky escape over the Barry Crauder story from a recent news article, but the Government is considering modifying the tax arrangements associated with forestry. Professional forestry companies such as Wodd will continue to pay no tax on forestry profits, but private individuals such as Mr Crauder will be taxed on profits just as they would for any other business. The Government is taking this action because public opinion is against granting generous tax relief to wealthy individuals.

For the moment, this is all highly secret. The minister responsible for forestry has spoken to the chairmen of all of the major forestry companies on the basis that each gives a personal guarantee to respect the Government’s confidence. The minister has done so because she is concerned that stock markets will panic when the news of the tax changes are announced next week. If the shareholders incorrectly believe that we will lose the tax shield on our profits then the share price will drop like a stone. We will be able to announce that we are aware of the changes and that we will not be taxed differently because of them.

I have spoken to the Board about this, making them promise not to repeat any of this information. We have called in and briefed the key analysts who advise the main institutional investors in Marland on the forestry industry.

As things stand, we can expect a lot of the wealthy individuals who own forests to divest themselves as soon as they discover that there are no more tax incentives. That will have significant implications for Wodd, both directly and indirectly.

The Board believes that the markets will overreact when the tax changes are first announced and that we will be unable to do much to manage that. One suggestion that has been put forward is that we should increase the dividend slightly as a signal that we are confident in the future strength of the industry. I suspect that the executive directors are just a little too concerned with the fact that they all have stock options that can only be exercised on a date that falls just after the government is due to announce its intentions on tax.

I need your thoughts in order to have an independent viewpoint from that voiced by the Board:

What effect will the tax changes have on our business?

Do you agree that briefing the analysts will mitigate the risk of our share price overreacting when the tax changes are announced?

Will the additional dividend payment help to maintain the share price?

Is granting executive stock options always a sound basis for aligning the interests of the executive directors and the shareholders?"