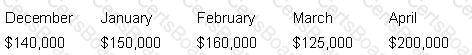

Company J is looking to perform an A/R cash analysis based on the following sales information:

60% of sales are collected within two months after sale. After three months, $135,000 of January's sales were collected. What was the dollar amount of January's sales collected in April?

Company ABC experienced a loss in the past when an employee in the treasury department was able to transfer $1.5 million to a personal account offshore. The company is working with a security agent to prevent this from happening in the future. ABC also accepts a large number of checks as payment. The agent has suggested upgrades to ABC’s payment process. What step should be taken to help mitigate this type of risk in the future?

Economists are forecasting a rise in gas prices within the next 3 months. Charged with the task of establishing a risk mitigation approach for the company, the CRO has determined that the company has considerable exposure to fluctuations in gas prices. In coming to this conclusion, the CRO:

Based on the following information, what is the required collected balance to cover all monthly service charges?

Deposit Float$10,000

Reserve Requirement5%

Earnings Credit Rate15%

Monthly Service Charges$6,000

Days in month30

Which institution or accord was approved in 2009 to strengthen the regulatory capital framework for banks by focusing on minimum capital requirements, supervisory review and market discipline?

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?

Financing decisions in a budget are used to construct all of the following pro forma financial statement components EXCEPT:

A bank issues a letter of credit (L/C) and receives a request for payment under the L/C. The buyer notifies the issuing bank not to make payment because there is a dispute over the quality of the merchandise. However, the documents received fully comply with the terms of the L/C. Which of the following statements is true?

What is the PRIMARY issue that management needs to consider when determining capital structure?

In terms of capital structure, lease financing normally has the same effect as:

One reason for using a sale and lease-back arrangement in lease financing is to:

With respect to the Sarbanes-Oxley Act, a company may avoid additional reporting requirements by:

An arrangement in which a borrower makes periodic payments to a separate custodial account that is used to repay debt is known as a:

Company XYZ has determined that its weighted average cost of capital is 12.5%. The capital structure of the company is made up of 75% equity and 25% debt. The before-tax cost of debt is 10%. Given a tax rate of 34%, what is XYZ's cost of common stock?

ASC Topic 815 (FAS 133) is applicable when accounting for which of the following?

A distribution business has used several bank loans to finance its expansion plans. After a fire destroyed the company’s facility and inventory, it went out of business due to the loss of revenue during the month it was closed. What type of insurance coverage should the company have had to prevent its demise?

A company hires an investment firm to fully underwrite a new stock issuance. Which of the parties carries the MOST risk?

When a project has an initial cash outflow with cash inflows in subsequent years, what decision model is most applicable to use to evaluate the adequacy of the project?