What is the reserve-requirements provision of the Federal Reserve Act of 1913 known as?

A U.S. bank regularly transmits international payments to European based XYZ Bank. The payments flow through an intermediary bank. Recently regulators audited the intermediary bank and discovered the bank may be unknowingly facilitating illegal activities. What payment method was MOST LIKELY used?

Merchant XYZ has total credit card sales of $20,000 for one day with an average ticket of $200. The merchant’s interchange reimbursement fees are 2% and transactions fees are $0.05. This merchant receives net settlement. Which of the following is the value of the deposit for that day?

Which of the following factors will allow a company to decrease the amount of collected balances required to compensate its bank for services?

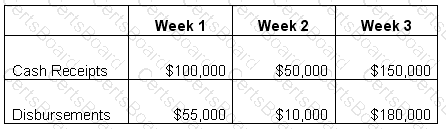

A company has a beginning cash balance of $50,000. Its weekly cash flow forecast shows the following information for the next three weeks.

Which of the following statements is true?

A company purchases a machine tool with an expected life of 3 years. Under the accrual accounting method, the equipment would be treated in which of the following ways?

Which of the following should NOT be a consideration when setting an optimal dividend policy?

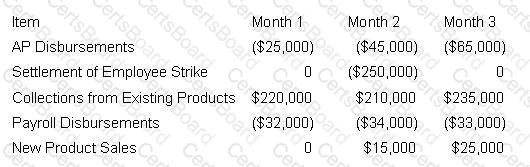

Company A anticipates the following cash inflows and outflows for the next three months:

If the company's treasurer is preparing a cash-flow projection for Month 2, and he is focusing purely on items that can be projected with a fair degree of certainty, what will the net projection be?

Which of the following would be used to evaluate only the effects of varying interest rates while holding all other values constant at their expected levels?

All of the following would encourage a company operating nationwide to develop multiple banking relationships EXCEPT:

A company can dispute any check alterations within how many days after the bank statement has been sent?

A manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments:

P-card issuer: $25,000

Payroll: $125,000

Bond interest payment: $200,000

Vendor payments: $260,000

Utilities: $50,000

The cash manager does not have a way to confirm the receivable amounts deposited at the bank. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments would threaten the company’s just-in-time production. What concern should the company have?

The delay between the time a check is deposited and the time the company's account is credited with collected funds is known as:

Which of the following services allows a bank to match checks presented for payment against company check issuance data?

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

A company is looking to outsource its accounts payable function. What KEY requirement would the treasurer include in the outsourcing policy?

A multinational firm headquartered in Germany expects the U.S. dollar to depreciate relative to the euro in the next few weeks. To counteract this expectation, the firm will lead payments from its only subsidiary, located in New York City. What situation could the firm encounter by employing this practice?

The board of directors of ABC Corporation has asked the CFO to consider adopting the direct method in preparing cash flow statements instead of the indirect method currently in use. Why would the board of directors promote this shift?