A manufacturing company has no liquidity and needs to purchase additional inventory in 60 days. Which of the following would have helped the company plan for this situation?

U.S.-based manufacturing Company XYZ is looking to deliver finished goods to ABC Company in a developing nation. The credit department wants to ensure collectability and has asked the treasury department for guidance. The desired solution may impact days sales’ outstanding but will have the lowest credit risk to Company XYZ. What will treasury recommend?

ABC Company, a publicly held U.S. multinational, owns several manufacturing plants in Latin America as well as several ships to transport its products globally. 60% of its sales are from its euro-based subsidiaries. The company uses various derivative instruments to mitigate exposure to fluctuations in fuel prices and FX rates. The hedging deals are long-term and placed with many counterparties. ABC Company is also a net borrower and has a syndicated credit facility in place. Which of the following actions to mitigate counterparty risk would MOST benefit the company?

A company converts the expense processing for its sales team from reimbursement by check to providing the team with travel and entertainment cards. Immediately, the company’s expenses for the sales force increase by 10%, with no concurrent increase in sales volumes. What aspect should the company have covered in their policies for card use to prevent the increased expenses?

XYZ Company is a publicly held manufacturing company that has decided to branch out into the international market. Five million dollars is needed to set up management and hire the factory workers, $2 million for various government certifications in order to begin business in Poland, and $1 million for miscellaneous expenses. While looking for funding, XYZ found that local banks in Poland were not willing to provide financing without which of the following?

A customer buys a laptop for $850 and a CD for $13. Only items with sale price of $15 and greater are subject to value added tax (VAT). Assuming VAT of 8.5%, how much tax does the customer incur at the point of sale?

A U.S. bank is actively trying to establish its operations in an emerging market country, but is not experiencing much success due to differences in the business culture. To gain some market share, an executive of the bank decides to give the son of a local dignitary a highly paid position in the organization. Furthermore, the dignitary is a person of interest on various terror watch lists. Sanctions can be placed on the bank because the executive did NOT establish compliance with which of the following?

On which exchange is a company’s stock traded on the over-the-counter market?

At the end of the year, ABC Company’s actual revenue is $85,000,000 versus budget revenue of $90,000,000. Actual operating expenses are $20,000,000 versus budget operating expenses of $22,000,000. Budget variance analysis would indicate a(n):

In evaluating alternative capital investments, a company should consider qualitative factors such as:

Usually, corporations receiving dividends from another corporation can exclude 70 percent of dividend payments from income for tax purposes as long as the stock is owned for at least:

Using a digital certificate when accessing a financial services provider is one way to reduce what kind of risk?

XYZ Inc. is a publicly traded company with revenues of $1B and an operating profit of 7.5%. The treasury organization consists of a treasurer and an assistant treasurer. The assistant treasurer is responsible for the creation and approval of all payments. The treasurer is responsible for compilation of the financial statements. Under Section 404 of the Sarbanes-Oxley Act, what should be viewed as a concern?

On June 1, a manufacturing company experienced a system failure that lasted more than 24 hours. The company did not have any contingency plans in place and as a result the cash manager was unable to process the following payments: $25,000 to the p-card issuer, $125,000 for weekly payroll, $500,000 for a bond interest payment, $260,000 for the weekly vendor payments and $50,000 for the monthly utilities. The receivables were deposited at the bank; however, the cash manager does not have a way to confirm the amounts. The suppliers are threatening to stop shipments due to the delay in payment and the loss of supplier shipments threatens the company’s just-in-time production. What did the manufacturing company trigger as a result of the system failure?

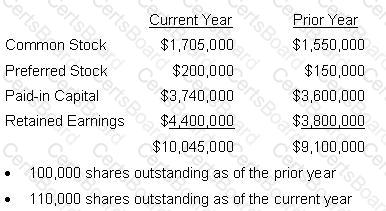

Equity section of Fisher, Inc. Financial Statement

If an investor paid $1,400.00 (excluding fees) for 75 shares of common stock, what was the market value of Fisher, Inc. at the time of purchase?

Sign Company and Paint Company have a twenty-year business relationship, and they work together when sending and receiving payments. Sign Company also does a large amount of business with Brush Company, a subsidiary of Paint Company. Brush Company’s Treasurer recently received a memo from the Treasurer of Paint Company reminding it that when dealing with vendors, extensive information is required when receiving or making ACH payments. What ACH payment format are Sign Company and Paint Company MOST LIKELY to use?