A company is filing for bankruptcy protection and is concerned about the welfare of its sizeable retiree population. Under ERISA, it is obligated to perform which of the following actions regarding its defined benefit plan?

A company's lockbox bank, which processes 24 hours per day, has a 6:00 P.M. ledger credit cutoff and grants same-day availability on checks drawn on Bank B that are received by 10:00 P.M. Which of the following ledger and collected credit postings would result from a Bank B check received at 11:00 P.M. on Tuesday?

An olive oil producer in Macedonia is arranging for shipment of its product to an international distributor. To support this activity, the company arranges for export financing because:

When a foreign subsidiary pays a dividend to its parent company the transfer of funds may be subject to:

Which of the following is the appropriate strategy to use for an active portfolio manager who is faced with an upward sloping yield curve?

A firm’s air conditioning unit breaks down unexpectedly and must be replaced immediately. What type of liquidity requirement is this an example of?

XYZ Company has incurred a financially devastating event because of a hurricane at its offshore manufacturing plant. Due to the impact on liquidity, the company may not be able to survive. What should the Treasurer have done in order to assess the risk associated with this type of event?

Which of the following would increase if the Fed were to announce a reduction in reserve requirements?

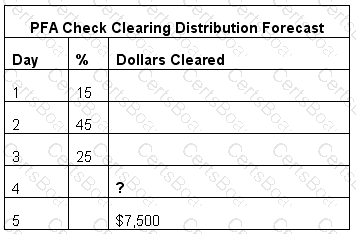

PFA Corporation has used regression analysis based on historical data to determine the estimated portion of dollars of checks issued that will clear on any given business day.

If PFA issued $150,000 in checks and $7,500 worth of checks cleared on day 5, what value of checks will be estimated to clear on day 4?

Company ABC is a restaurant chain that has enjoyed a surge in customers’ dining with not much of a profitability increase in the last couple of years. Following a bad restaurant review, customer traffic deteriorated with not much change in profitability. Which of the following BEST describes the cost structure of the company?

A cash manager is determining the threshold over which cash concentrations will be done by wire. An ACH transaction costs $0.50. A wire costs $12.00. Funds are available 2 days quicker by wire and the opportunity cost of funds is 5%. What threshold should the cash manager use?

MCA, Inc. upgraded the Treasury workstation that had been in place for two years and used data from that 24-month period to develop a new short-term forecast. A trend factor was applied to controlled disbursements of 97% on a month-by-month basis and the variance to actual disbursements is less than 1%. Which of the following model validation techniques was utilized?

The Treasurer at ABC Company currently uses an in-house company-processing lockbox center. The Treasurer has asked for an analysis to determine the major advantage of using a traditional check/mail-based lockbox system. ABC receives 287,000 payments per month and hired seven additional staff members to process the payments in-house. Additionally, $389,000 was invested in the equipment used to process the payments and NSF checks have decreased 7% since using the in-house center. The equipment’s current market value is equal to its book value. What major advantage should the analysis indicate?

Based on the following information, how much money will XYZ Company owe the bank for monthly service charges after the earnings credit is applied?

Average Ledger Balance $500,000

Deposit Float$10,000

Reserve Requirement10%

Earnings Credit Rate5%

Monthly Service Charges$5,000

Days in month30

The Cash Manager of ABC Logistics, Inc. sets a daily cash position by noon. All departments have been given an 11 a.m. cut-off for presenting wire requests and 2 p.m. for ACH requests. A wire request came in at 3:30 p.m. to make an insurance premium payment, in order to receive a discount. What liquidity reserve requirement is impacted?

A treasury manager has $5 million that is not needed for 6 months. The treasury manager has decided to invest the funds in a liquid instrument, using the current portion of a 5-year AA rated corporate bond that is subject to U.S. Securities and Exchange Commission (SEC) regulations. In what market would the treasury manager purchase this investment?

PTC Corporation has determined that the threshold amount for initiating a wire transfer vs. an ACH payment for concentrating funds is $60,225. Wires cost $9.00 and save one day of float. If the opportunity cost is 5%, what is the cost of the ACH payment?

A company’s Chief Financial Officer assigns a team reporting to the Treasurer to restructure the company’s complex debt instruments and equipment leasing arrangements. The team executes the required settlement transactions using wire payments to facilitate the new debt structure, and in the process violates the lending requirements of the company’s bank. What should the Treasurer have done to prevent the violation?