A company agrees to pay ¥10,000,000 for a shipment from Japan. At the time the purchase order is placed the exchange rate is ¥168/US$. At the time of payment the exchange rate is ¥163/US$. What is the net effect on the dollar cost of the shipment if the transaction has NOT been hedged?

LST Company is a publicly traded company with $120 million in sales. Historically, LST does not extend credit to customers beyond net 45 terms. To help promote sale of a new product introduced into the market this year, LST offered financing terms to customers purchasing the new product. As a result, sales increased by 15% from the prior year and accounts receivable increased by 5%. At the end of their fiscal year LST had a $15 million sale to a new customer that was recorded as a note receivable. LST recognizes revenue when goods leave the facility. During the financial audit the auditors discovered that the customer did not receive the product until three days after the year-end. Under GAAP accounting, the auditors would MOST LIKELY render a(n):

A diversified industrial company operates multiple remote manufacturing facilities that manage local supplier relationships. The company draws on a single line of credit for all of its working capital needs. Which of the following types of disbursement systems would BEST meet this company's needs?

I. Banker’s acceptances

II. Commercial paper

III. U.S. Treasury bills

IV. Federal agency securities

Which of the following is the MOST usual ranking, from lowest to highest risk, of the investments listed above?

All of the following are reasons to use a confirmed irrevocable letter of credit EXCEPT concern about:

In most countries other than the United States, which of the following is used to compensate banks for services provided?

A merchant, wanting to accept credit cards as payment method, will negotiate its fees with which of the following participants?

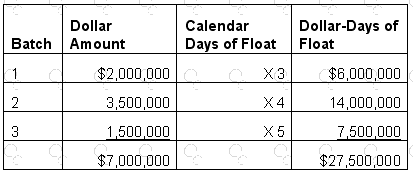

There are 31 calendar days in the month, and the opportunity cost of funds is 9%.

What is the annual cost of float for the batches listed?

Which of the following would MOST LIKELY cause a decrease in a company's deposited checks availability?

A company may choose to use a derivative to reduce risk on which of the following types of exposure?

I. Currency

II. Interest rate

III. Commodity price

All of the following factors influence a company's decision to use electronic commerce EXCEPT:

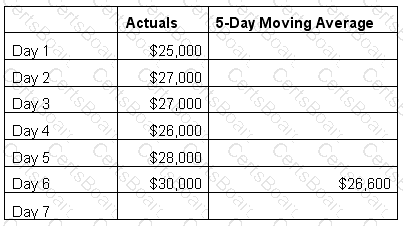

Company XYZ uses exponential smoothing to forecast its daily lockbox receipts. With the help of a statistical computer program, the company has determined that the smoothing constant is 0.35.

Using the data in the table, what is the exponential smoothing forecast for Day 7 (rounded to the nearest whole $)?

All of the following are common consumer-to-corporate international payment mechanisms EXCEPT:

Which of the following business practices does NOT comply with the Uniform Commercial Code?

A company has made an investment of $30,000, which matures in 180 days and pays $800 in interest. Which of the following is the effective annual yield?

"Fees" in Country Y, which would be considered bribes in the United States, are ingrained in the commercial culture. A U.S. company doing business in Country Y:

Which of the following statements is (are) true about non-repetitive wires?

I. They may require additional security steps.

II. They are typically used for cash concentration.

III. They may be used for transactions where dates, parties, and/or amounts may be variable.