A high-yield, non-investment-grade security is commonly referred to as which of the following?

The PRIMARY objective of the AFP Account Analysis Standard is to help cash managers in which of the following areas?

A company that has a nationwide workforce may use which of the following methods for disbursing payroll to minimize the number of bank accounts?

I. Payable through draft

II. Multiple drawee checks

III. ACH credit transfers

A residential mortgage company that wants to collect monthly payments from customers electronically via the ACH would initiate:

The time from the deposit of a check in a bank account until the funds can be used by the payee is known as:

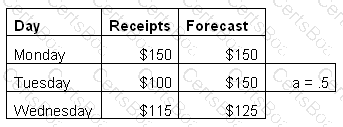

On the basis of the data above,

what is the forecast for Thursday's cash receipts, under the exponential smoothing method?

Which of the following short-term instruments is used to finance the import or export of goods?

Given a corporate tax rate of 34%, a tax-exempt yield of 7% is equivalent to a taxable yield of:

Which of the following is an advantage of a decentralized disbursement system?

Which of the following investment instruments would provide a company with the greatest liquidity and least risk?

Buying a security with the intent of selling it prior to its maturity date to increase the return is an example of:

An increase in the availability float on a company's collections would cause a reduction in which of the following?

I. Earnings credit

II. Ledger balance

III. Service charges

IV. Collected balance

The time between receipt of a mailed payment and the deposit of the payment in the payee's account is known as:

Under which of the following circumstances is lengthening the disbursement mail float NOT a benefit to the disbursing company?

The time between when the payor mails the check and the payee receives available funds is known as: