An increasing number of multinational companies have adopted formal multilateral netting systems for which of the following reasons?

Measurement of a company's liquidity includes the calculation of all of the following EXCEPT:

In analyzing the costs for services among several banks, a cash manager should compare all of the following EXCEPT the:

Which of the following is an example of a company's internal data used for cash management?

Money market funds are able to obtain very competitive trading terms because:

When a company announces a significant and unexpected dividend increase, it signals to the market that management expects:

The Treasury Department of ABC Corporation has been working hard to prevent external fraud from impacting its operating bank accounts. Recently, they implemented protective services on their disbursement accounts. This morning, the treasury analyst realized that an expected sales tax payment to the state of Maryland had not occurred. The analyst knew that it had been successfully initiated yesterday. Which service used by the corporation may need to be adjusted to pay the state of Maryland?

On a daily basis, the cash manager is responsible for all of the following EXCEPT:

In a private label financing arrangement, the seller does which of the following?

A nationwide retailer has been making EFT payments to its suppliers for several years. It will expand its processes to include consumer payments in its EFT initiative. Which of the following will support this initiative at the point-of-sale?

What is the premium (price) for an oil contract, if the following conditions are present?

LIBOR rate of 5%

Out of the money cost of $3

Strike price is $4

In the money price of $1

Speculative premium of $2

A company has six fraudulent checks clear its primary disbursement account for a total of $7,652. The bank agrees to split the loss with the company to maintain a good relationship. As a condition of sharing the expense, the bank requires the company to establish positive pay on its disbursement accounts or have the company absorb the losses on future fraudulent payments.

If the company determines that positive pay is too expensive and decides NOT to implement it, what type of risk financing technique is the company using?

Making payments through electronic payments networks can be a part of a treasury management system’s functionality, but it is subject to numerous constraints. Which of the following is a true statement of those constraints?

Which of the following types of risk would an investor who does NOT receive payments on a security under the original terms be subject to?

A company wants to gather daily balance reporting from its international subsidiaries' bank accounts. Which of the following systems would allow the company's bank to gather the balance positions from the local banks?

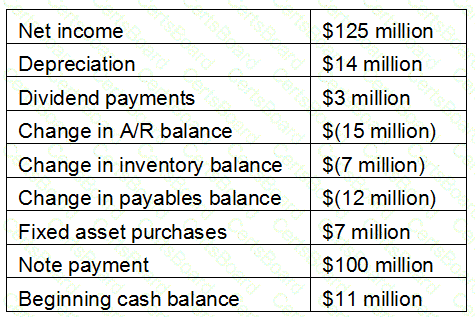

The treasury analyst at RST Corporation has been asked to forecast cash levels for the company’s year-end balance sheet. The analyst has been given the following information:

What should the analyst project as the upcoming year-end cash balance?

Which of the following correctly describes pooling as practiced in the European cash management environment?

Following the latest round of cost-cutting measures at ABC Corporation, the Treasury Department retained a headcount of 2 individuals. While the analyst was out sick, she gave her password to her Manager so that payments could be released via the bank’s wire transfer system. The Manager sent 3 wires out with incorrect banking instructions. The problem was not identified until the angry suppliers called several weeks later demanding payment. The corporation has not yet recovered the $130,000 sent to erroneous accounts. In this instance, which control failed for ABC Corp.?

A company has a $300,000 credit line of which $200,000 was the average amount outstanding for the year. The terms of the loan include a 1/2 of 1% commitment fee on the unused portion, an interest rate of 10%, and a compensating balance requirement of 2% of the total credit line. The company's compensating balances are funded from credit-line borrowings.

If the company negotiates to eliminate the compensating balance requirement and the average borrowings remain at $200,000, the annual interest rate would be:

Examples of fixed assets include which of the following?

I. Inventory

II. Treasury bills

III. Forklift

IV. Goodwill