Which of the following is responsible for liquidating the assets of failed financial institutions?

All of the following statements are true about adjustable-rate preferred stocks EXCEPT:

Which of the following would be the most efficient method of reducing the number of cross-border payments between two units of a company?

A company has negotiated a credit facility with the following terms:

$5,000,000 line of credit

$3,000,000 average borrowing

30 basis point commitment fee on unused portion of line

Interest rate on advances is 1-month LIBOR plus 4%

1-month LIBOR is currently 2%

Compensating balance requirement of 20% on the outstanding borrowings

What is the effective annual borrowing rate for the line of credit?

A U.S. company’s pension plan is managed by an investment management firm, headquartered outside the United States. The investment management firm outsources the accounting for the plan to an organization on the Office of Foreign Assets Control (OFAC) sanctions lists and the firm does not advise the U.S. company of this fact. A financial loss in the pension plan is later realized due to the mismanagement of funds. When establishing its contract with the firm to protect itself from losses in the pension plan, the company should have:

Treasury uses which of the following internal sources of information in its daily operations?

West Coast Retail Shop has experienced reduced cash availability in its bank account since a new store manager was hired. The manager is responsible for manually preparing daily bank deposits, which generally include a large number of checks, for processing at a bank branch in the same shopping mall as the store. Which of the following should West Coast Retail Shop implement to improve the available balance in its bank account?

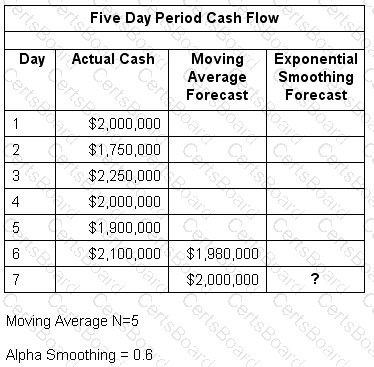

QRT Corporation uses exponential smoothing in its cash flow forecasting model. Five days are used to calculate the moving average forecast.

If the value of the smoothing constant is .60, what is the exponential smoothing forecast for day 7?

During a company’s cash flow analysis review it discovers that for every 10 new customers it gains, there is an increase of 2% in its float costs associated with the payment methods it offers. If the company pursues faster collection methods for payments, resulting in greater availability of surplus cash with a correlating decrease in the need to issue commercial paper, what risk will the company mitigate?

A company can use all of the following documents to establish a relationship with a bank EXCEPT:

A retail lockbox system is characterized by which of the following?

I. An emphasis on processing cost

II. Detailed information on discounts taken

III. Small-dollar amounts per invoice

IV. Multiple invoices per payment

The rate of interest commercial banks charge their best credit rated customers is called the:

The renegotiation of trade payment terms in an e-commerce environment should include which of the following?

Which of the following can be considered key responsibilities of daily cash management?

I. Overseeing compensation for bank services

II. Management of short-term borrowing and investing

III. Projecting future cash shortages and surpluses

The Treasury Manager of a privately held company is looking to finance new equipment that has a useful life of 5 years. What type of financing would the Treasury Manager MOST LIKELY employ to finance the equipment?

U.S. dollar-denominated instruments issued by foreign banks through their domestic branches are known as:

Which of the following is NOT characteristic of commercial paper with a term of less than 270 days?

A good credit rating has which of the following effects on debt?

I. Improved marketability

II. Decreased cost of funds

III. Decreased maturity

IV. Increased dealer fees