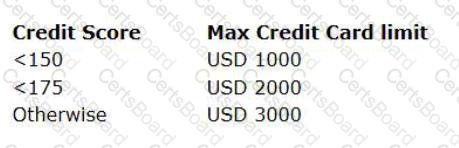

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

U+ Bank realizes that customers have ignored a particular mortgage offer. As a result, the bank wants to offer the action 30% more frequently. Which arbitration factor do you configure to implement this requirement?

U+ Bank has recently implemented a cross-sell on the web microjourney and is satisfied with the results. The bank now wants these Next-Best-Action recommendations to be delivered via outbound communication channels. Select two outbound channels that U+ bank can use to deliver Next-Best-Action recommendations. (Choose Two).

U+ Bank, a retail bank, follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card. Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?