If a corporation pays 70% of its current earnings to its stockholders in the form of cash dividends, the remaining 30% kept by the company will cause a(n):

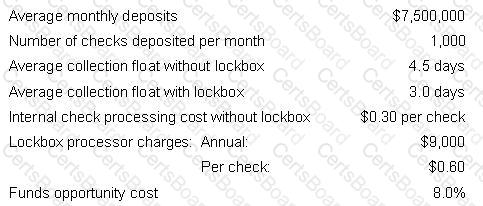

A company that is considering using a central lockbox for collections has conducted an initial study and determined the following:

What will be the annual net dollar benefit to the company if it uses a lockbox?

For a retirement plan to be qualified under ERISA, employer and employee contributions must be:

When a short-term loan is paid with a lump sum payment and the payment includes both interest and principal, the loan is often referred to as a:

Multi-divisional or multi-subsidiary companies have opportunities to optimize their working capital position and overall liquidity by doing which of the following?

The actions taken by a company regarding crisis management, alternative operating procedures, and communications are referred to as:

The primary bank for a major multinational company would use an overlay structure for euro zone cash concentration under which of the following circumstances?

A major toy retailer operates 65 stores throughout the Midwest. Which of the following collection methods is MOST LIKELY to be used by this company?

The U.S. government agency that administers and enforces trade sanctions against targeted foreign countries is the:

In developing treasury policies and procedures, which activity requires key controls to be in place?

In an international banking system, what role is commonly carried out by a large group of clearing banks?

An auto manufacturer experienced a decline in sales, an increase in inventory, and an increase in labor costs over the past two months. With all else being equal, what is the MOST LIKELY impact to the company's balance sheet?

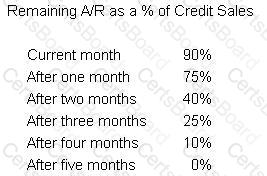

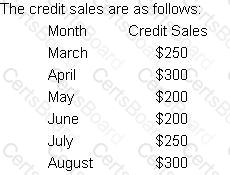

A company's accounts receivable balance pattern is shown in the first table. Credit sales are shown in the second table.

What is the cash inflow for the month of August?

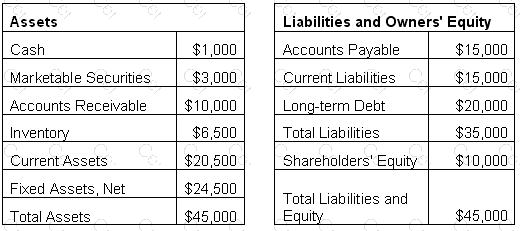

The before-tax cost of long-term debt is 10% and the cost of equity is 12%.

The marginal tax rate is 35%. The company's weighted average cost of capital is:

The PRIMARY difference between money market instruments and capital market instruments is that capital market instruments are securities that are:

Company TUV listed on the New York Stock Exchange two months ago. The investor relations manager will be responsible for:

Which of the following must be considered when designing the basic framework for a cash management system?

The Treasurer of a publicly-traded U.S. company discovers several large payments which were made from the company’s disbursement account without proper approval. These unauthorized payments represent an exposure to penalties imposed by which regulator?