During the year a piece of equipment that originally cost $96,000, with accumulated depreciation of $39,000, met the criteria of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations to be classified as held for sale.

The equipment is being advertised for sale at $46,000 and costs of $1,000 will be incurred to enable the sale to be completed.

At what value should the equipment be included in the statement of financial position at the year end assuming that it remains unsold?

Give your answer to the nearest whole number.

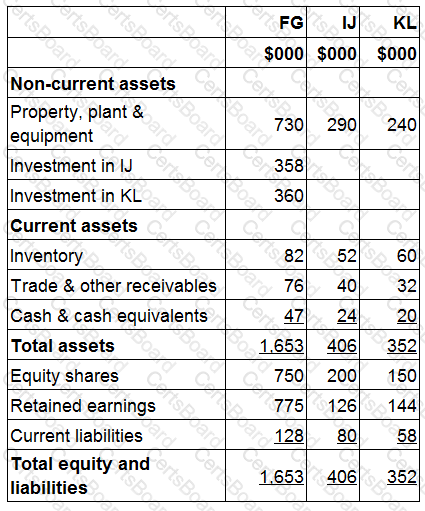

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the total goodwill to be included in FG's consolidated statement of financial position as at 31 December 20X5.

Give your answer to the nearest whole $.

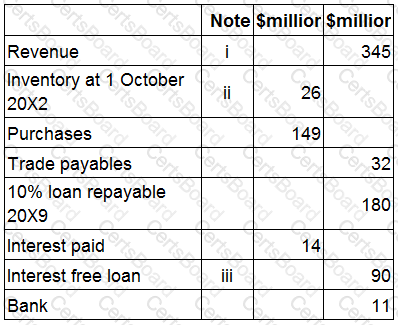

The following information is extracted from the trial balance of YY at 30 September 20X3.

i. Included in revenue is a refundable deposit of $20 million for a sales transaction that is due to take place on 14 October 20X3.

ii. The cost of closing inventory is $28 million, however, the net realisable value is estimated at $25 million.

iii. The interest free loan was obtained on 1 January 20X3. The loan is repayable in 12 quarterly installments starting on 31 March 20X3. All installments to date have been paid on time.

Calculate the cost of sales that would be shown in YY's statement of profit or loss for the year ended 30 September 20X3.

Give your answer to the nearest $ million.

XYZ operates in Country A where tax rules state that entertaining costs and donations to political parties are disallowable for tax purposes.

XYZ calculated both its accounting and taxable profits for the year ended 31 December 20X2 after deducting $10,000 of entertaining costs.

It is considering what impact the ruling that "entertaining costs are disallowable for tax purposes" will have on its two profit figures.

Which of the following correctly states the impact of the ruling on the profits already calculated?