Company A is based in country A with the AS as its functional currency. It expects to receive BS20 million from Company B in settlement of an export invoice.

The current exchange rate is A$1 =B$2 and the daily standard deviation of this exchange rate = 0 5%

What is the one-day 95% VaR in AS?

A venture capitalist is considering investing in a management buy-out that would be financed as follows:

• Equity from managers

• Equity from a venture capitalist

• Mezzanine debt finance from a venture capitalist

• Senior debt from a bank

The venture capitalist is planning to work with the management to grow the business in anticipation of an initial public offering within five years.

However, the cash forecast shows a potential shortage of funds in the first year and the venture capitalist is evaluating the potential impact of cash being generated in the first year being significantly lower than forecast.

The most important risk that a shortage of cash would create for the management buyout is that the new company has insufficient funds to:

Company A, a listed company, plans to acquire Company T, which is also listed.

Additional information is:

• Company A has 150 million shares in issue, with market price currently at $7.00 per share.

• Company T has 120 million shares in issue,. with market price currently at $6.00 each share.

• Synergies valued at $50 million are expected to arise from the acquisition.

• The terms of the offer will be 2 shares in A for 3 shares in T.

Assuming the offer is accepted and the synergies are realised, what should the post-acquisition price of each of Company A's shares be?

Give your answer to two decimal places.

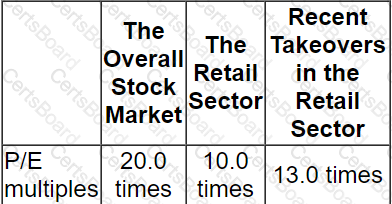

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?