A company currently has a 5.25% fixed rate loan but it wishes to change the interest style of the loan to variable by using an interest rate swap directly with the bank.

The bank has quoted the following swap rate:

* 4.50% - 455% in exchange for Libor

Libor is currently 4%.

If the company enters into the swap and Libor remains at 4%. what will the company's interest cost be?

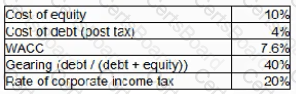

AA is considering changing its capital structure. The following information is currently relevant to AA:

The gearing rating raising the new debt finance will be 50%.

Which THREE of the following statement about the impact of AA’s change in capital structure are true under Modigliani and Miler’s capital structure theory with tax.

The value of a call option will increase because of:

The Board of Directors of a listed company wish to estimate a reasonable valuation of the entire share capital of the company in the event of a takeover bid.

The company's current profit before taxation is $10 0 million.

The rate of corporate tax is 20%.

The average P/E multiple of listed companies in the same industry is 10 times current earnings.

The P/E multiple of recent takeovers in the same industry have ranged from 11 times to 12 times current earnings.

The average P/E multiple of the top 100 companies on the stock market is 16 times current earnings.

Advise the Board of Directors which of the following is a reasonable estimate of a range of values of the entire share capital in the event of a bid being made for the whole company?