A company generates and distributes electricity and gas to households and businesses.

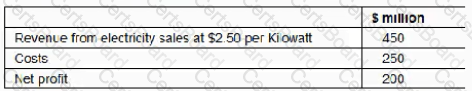

Forecast results for the next financial year are as follows:

The Industry Regulator has announced a new price cap of $2.00 per Kilowatt.

The company expects this to cause consumption to rise by 15% but costs would remained unaltered.

The price cap is expected to cause the company's net profit to fall to:

A company raised fixed rate bank finance together with an interest rate swap for the same term and same principal value to pay floating receive fixed rate interest on an annual basis.

Which THREE of the following statements are correct?

A company has:

• 10 million $1 ordinary shares in issue

• A current share price of $5.00 a share

• A WACC of 15%

The company holds $10 million in cash. No interest is earned on this cash.

It will invest this in a project with an expected NPV of $4 million.

In a semi-strong efficient stock market, which of the following is the most likely share price immediately after the announcement of the new investment?

A company wishes to raise new finance using a rights issue. The following data applies:

• There are 20 million shares in issue with a market value of $6 each

• The terms of the rights will be 1 new share for 4 existing shares held

• After the rights issue, the theoretical ex-rights price (TERP) will be $5.75

Assuming all shareholders take up their rights, how much new finance will be raised ?

Give your answer to one decimal place.

$ ? million