Which THREE of the following statements about stock market listings are correct?

A company is planning to issue a 5 year $100 million bond at a fixed rate of 6%.

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

The company predicts that Libor will be 4% over the life of the 5 years.

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct?

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

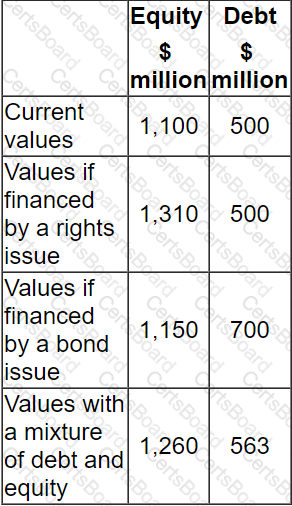

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

Company ABE is an unlisted company that has been trading for 10 years. During this period, it has seen substantial growth in revenue and earnings. For the company to continue its growth it needs to raise new finance The directors are considering an initial public offering (IPO).

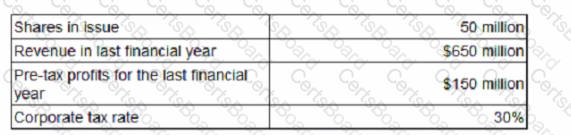

The following information is relevant to Company ABE:

A listed company of similar size and in the same industry as Company ABE had earnings per share in the last financial year of $1 80 Its shares are currently trading at a price / earnings ratio of 12.

The directors of Company ABE have asked for advice on what price they might expect if the company is listed on the stock exchange by means of an IPO.

Using the information provided what is an estimated issue price for each share in Company ABE?

Give your answer to 2 decimal places.